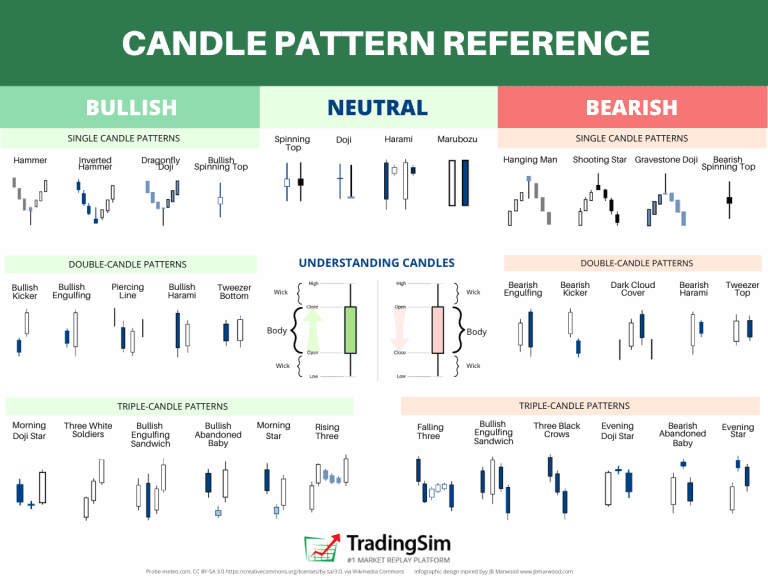

The world of trading can be complex and overwhelming, especially for beginners. However, there are various tools and resources available to help navigate the intricacies of the market. One such tool is the candlestick patterns cheat sheet, which provides valuable information on the different candlestick patterns that traders can use to make informed decisions. In this article, we will explore some popular candlestick patterns and their significance in trading.

Candlestick Patterns Cheat Sheet

Candlestick patterns are visual representations of price movements in the market. They are formed by the open, close, high, and low prices of a given period and are displayed in the form of candles on a chart. Each candlestick pattern has its own interpretation and can provide valuable insights into future price movements. Traders use these patterns to identify potential reversals or continuations in the market.

One of the most commonly used candlestick patterns is the “doji” pattern. This pattern consists of a small body with an equal or nearly equal open and close price. The appearance of a doji pattern suggests indecision in the market and can signal a potential reversal. Traders often look for confirmation from other technical indicators before making trading decisions based on doji patterns.

Another important candlestick pattern is the “hammer” pattern. This pattern is characterized by a small body and a long lower wick. The appearance of a hammer pattern indicates a potential reversal from a downtrend to an uptrend. Traders interpret this pattern as a sign of bullish sentiment in the market and may consider buying opportunities.

Another important candlestick pattern is the “hammer” pattern. This pattern is characterized by a small body and a long lower wick. The appearance of a hammer pattern indicates a potential reversal from a downtrend to an uptrend. Traders interpret this pattern as a sign of bullish sentiment in the market and may consider buying opportunities.

The “shooting star” pattern is another popular candlestick pattern that traders use to identify potential reversals. This pattern has a small body with a long upper wick, indicating a failed attempt to push prices higher. Traders interpret the shooting star pattern as a bearish signal, suggesting a potential downtrend in the market.

The “shooting star” pattern is another popular candlestick pattern that traders use to identify potential reversals. This pattern has a small body with a long upper wick, indicating a failed attempt to push prices higher. Traders interpret the shooting star pattern as a bearish signal, suggesting a potential downtrend in the market.

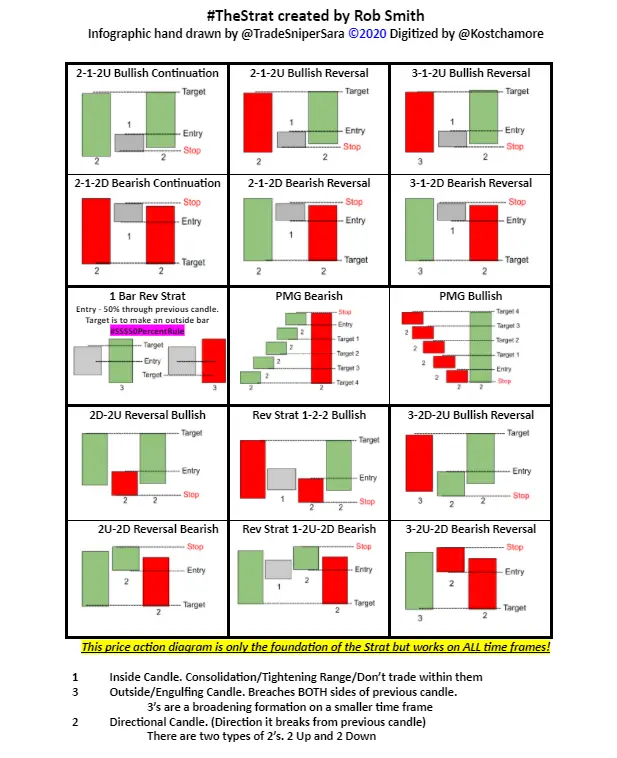

In addition to these patterns, there are many other candlestick patterns that traders can study and utilize in their trading strategies. Some patterns indicate trend reversals, while others suggest continuations. It is important for traders to familiarize themselves with these patterns and understand their implications.

In addition to these patterns, there are many other candlestick patterns that traders can study and utilize in their trading strategies. Some patterns indicate trend reversals, while others suggest continuations. It is important for traders to familiarize themselves with these patterns and understand their implications.

It is worth noting that candlestick patterns should not be used in isolation. They should be considered alongside other technical indicators and analysis techniques to make well-informed trading decisions. Traders should also practice proper risk management and set stop-loss orders to protect their investments.

In conclusion, the candlestick patterns cheat sheet is a valuable resource for traders looking to gain insights into price movements in the market. By understanding these patterns and their implications, traders can make more informed trading decisions. However, it is important to remember that trading involves risks, and proper risk management strategies should always be implemented. Happy trading!