When it comes to tax forms, one that often comes to mind is the IRS Form 1040. This form is a staple for individuals filing their annual income tax returns in the United States. It plays a crucial role in determining the amount of tax owed or the refund a taxpayer is eligible for. In this post, we will explore various aspects of the IRS Form 1040 and provide valuable insights to make the filing process seamless.

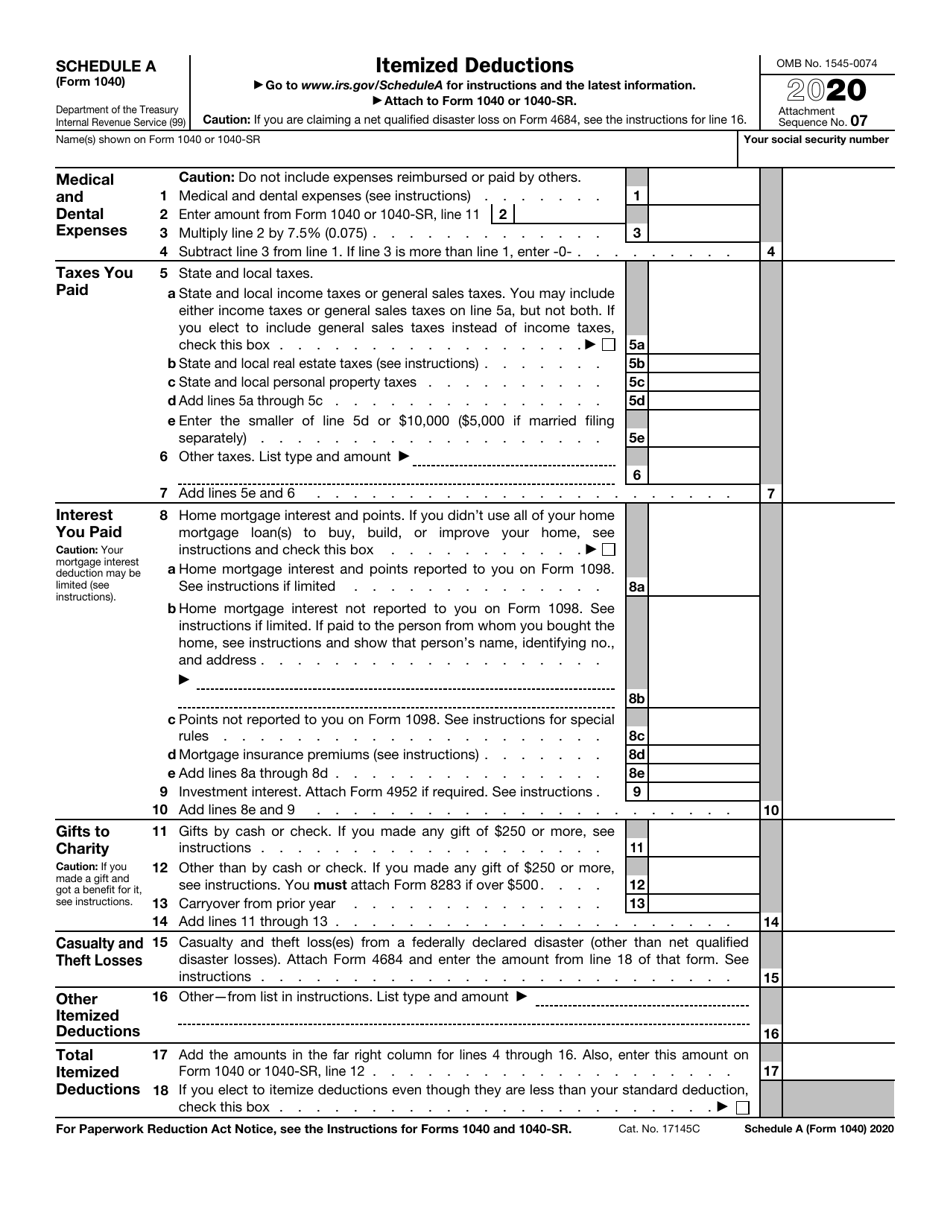

IRS Form 1040 Schedule A: Itemized Deductions

First on our list is the IRS Form 1040 Schedule A, which allows taxpayers to itemize their deductions. This form is essential for those who wish to claim deductions rather than taking the standard deduction. It covers various categories such as medical expenses, home mortgage interest, state and local taxes, and charitable contributions. By meticulously tracking and documenting these expenses, taxpayers might be able to save a significant amount on their tax bill.

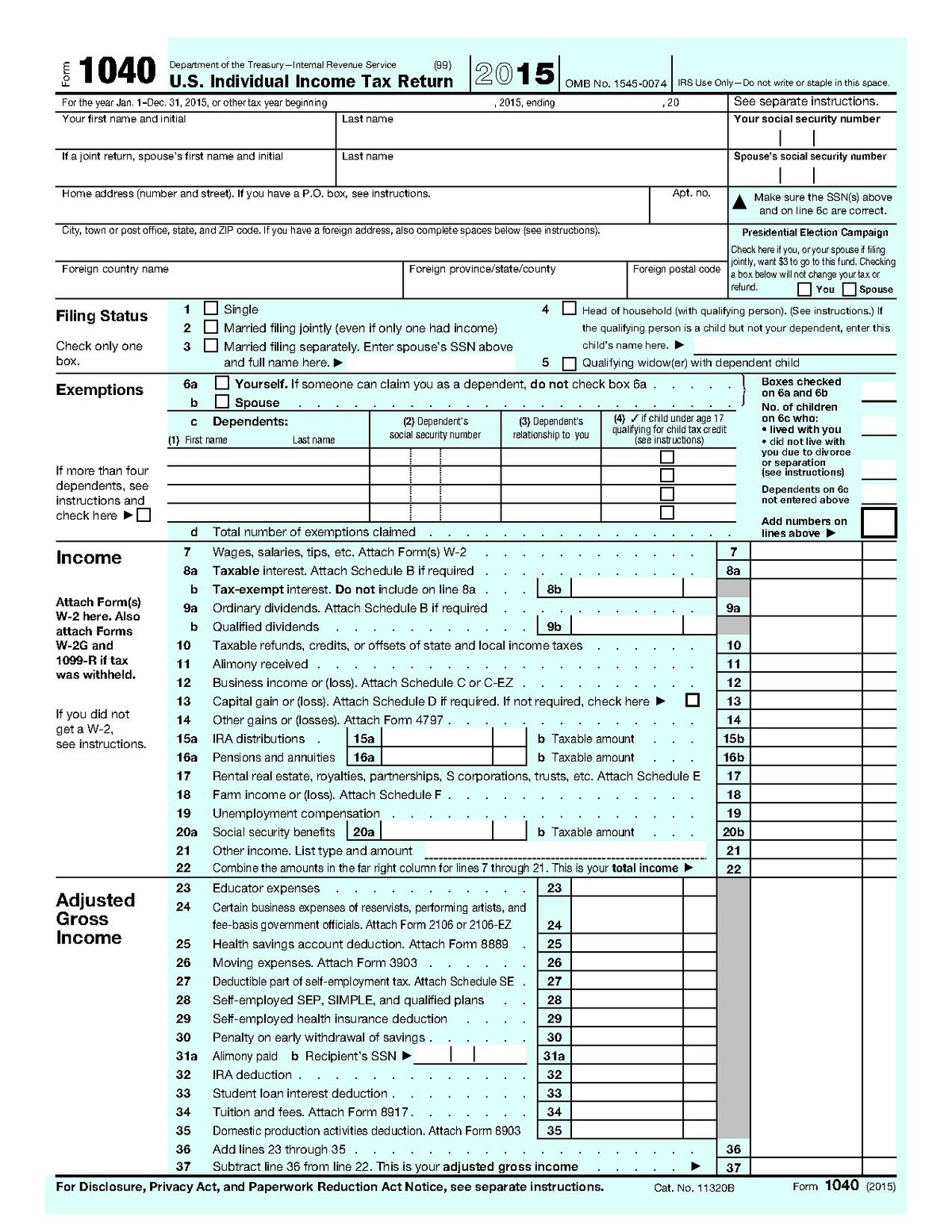

Form 1040 - Your Tax Reporting Companion

Form 1040 - Your Tax Reporting Companion

Another vital tax form is simply known as Form 1040. Sometimes referred to as the “long form,” it encompasses all income sources, deductions, and tax credits. While it may seem overwhelming initially, it provides a comprehensive overview of a taxpayer’s financial situation. It is crucial to fill out this form accurately to avoid any discrepancies or delays in processing your tax return. The Form 1040 helps ensure that taxpayers report their income correctly and claim any eligible tax credits.

2018 1040 Form and Instructions - A Valuable Resource

2018 1040 Form and Instructions - A Valuable Resource

For those who filed their taxes in 2018, the 2018 1040 Form and Instructions were instrumental in understanding the filing requirements. This form, accompanied by its detailed instructions, helped taxpayers navigate through the various sections and calculations. It served as a reliable resource for individuals who wanted to ensure that they were completing their tax return correctly.

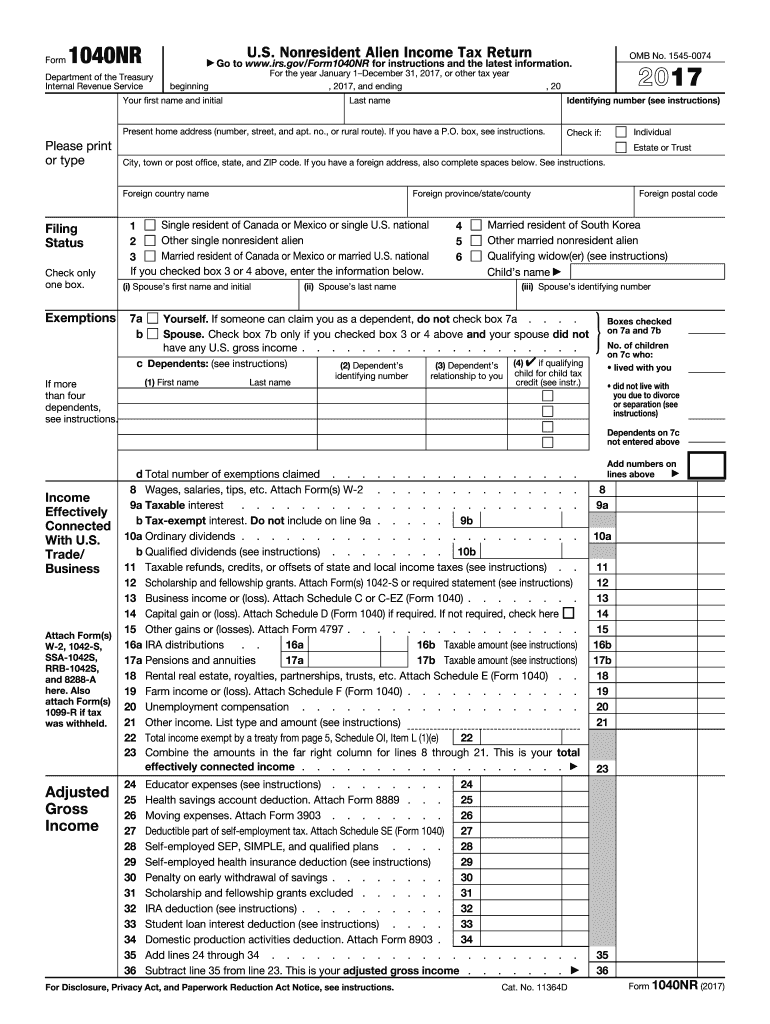

Electronic IRS Form 1040-NR 2018 - 2019

Electronic IRS Form 1040-NR 2018 - 2019

An important variant of the IRS Form 1040 is the 1040-NR, designed for non-resident individuals who have U.S. income or income from U.S. sources. This particular form takes into account the unique tax circumstances of non-resident taxpayers. Completing the electronic version of the IRS Form 1040-NR makes it convenient for eligible individuals to fill it out accurately and submit it digitally.

IRS 1040-NR 2017 - Fill out Tax Template Online

IRS 1040-NR 2017 - Fill out Tax Template Online

The IRS 1040-NR for 2017 offers another option for non-resident taxpayers who need to fulfill their tax obligations. Using an online platform, individuals can fill out the necessary information electronically, making the process faster and more efficient. By leveraging this digital solution, non-resident taxpayers can complete their tax returns promptly and accurately.

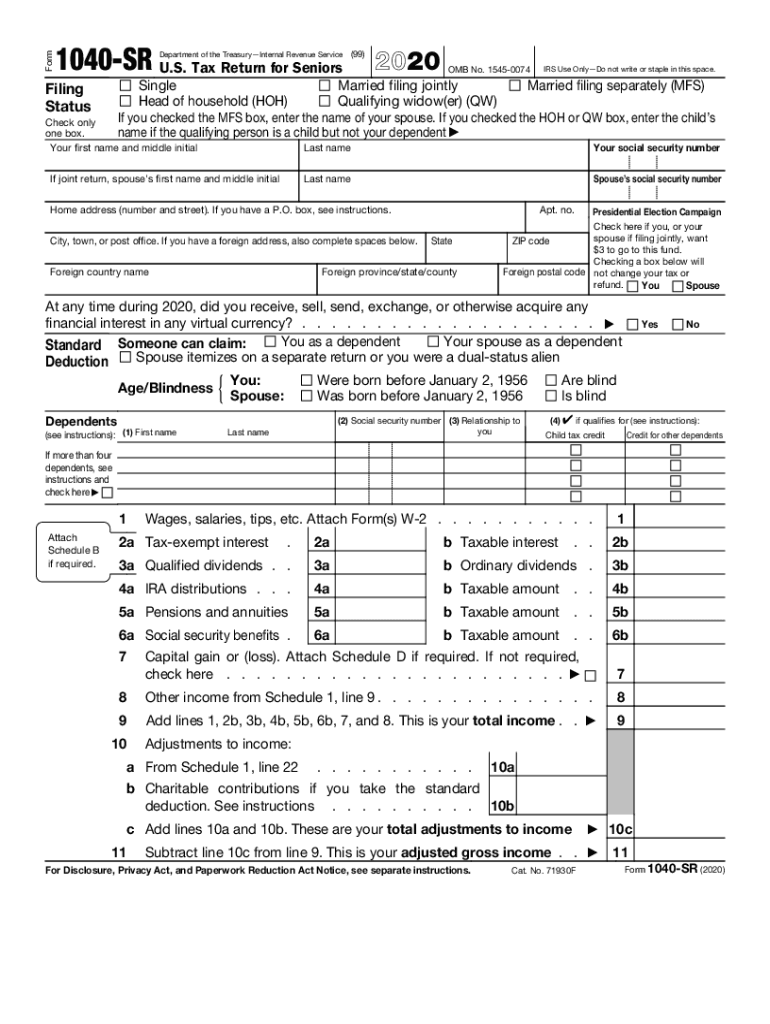

2020 Form IRS 1040-SR - Fill Online, Printable, Fillable, Blank

2020 Form IRS 1040-SR - Fill Online, Printable, Fillable, Blank

The 2020 Form IRS 1040-SR caters specifically to seniors aged 65 and above. This form recognizes the unique tax considerations and provisions that apply to the senior citizen demographic. By providing clear instructions and offering a digital fillable format, the IRS aims to simplify the tax filing process for older Americans.

These are just a few examples of the various forms and schedules associated with the IRS Form 1040. The IRS releases updated versions of these forms each year, incorporating any changes to tax laws and regulations. Now that you have a better understanding of the different components of the IRS Form 1040, you can approach tax season with confidence and complete your tax return accurately. Remember to consult a tax professional or utilize tax preparation software if you have any uncertainties or complex tax situations.

These are just a few examples of the various forms and schedules associated with the IRS Form 1040. The IRS releases updated versions of these forms each year, incorporating any changes to tax laws and regulations. Now that you have a better understanding of the different components of the IRS Form 1040, you can approach tax season with confidence and complete your tax return accurately. Remember to consult a tax professional or utilize tax preparation software if you have any uncertainties or complex tax situations.